Inventory & Purchase Order Financing

The term inventory financing refers to a short-term loan or a revolving line of credit acquired by a company so it can purchase products to sell at a later date. These products serve as the collateral for the loan. Inventory financing is useful for companies that must pay their suppliers for stock that will be warehoused before being sold to customers. It is particularly critical as a way to smooth out the financial effects of seasonal fluctuations in cash flows and can help a company achieve higher sales volumes by allowing it to acquire extra inventory for use on demand.

For example, if you’re running a new business and you suddenly get an influx of orders all at once, you might not be able to purchase the materials needed to get those orders filled and delivered within a reasonable time frame. As such, the key benefit of Inventory & PO financing is to help ensure that you don’t have to turn away business.

- Inventory financing is credit obtained by businesses to pay for products that aren’t intended for immediate sale.

- Financing is collateralized by the inventory it is used to purchase.

- Inventory financing is often used by smaller privately-owned businesses that don’t have access to other options.

- Businesses rely on it to keep cash flow steady, update product lines, increase inventory supplies, and respond to high demand.

- Although businesses don’t have to rely on personal or business credit history and assets to qualify, they may be stressed by additional debt if they’re new or struggling.

How Inventory Financing Works

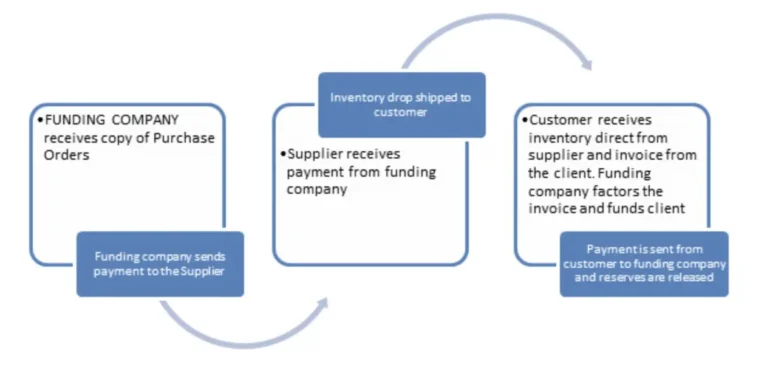

PO funding differs from a typical business loan. You’ll still apply for financing through a third-party lender, but the PO financing company doesn’t send the money to your business account. Instead, they’ll actually send it directly to your supplier. These loans actually look more like an After-pay or Affirm-type arrangement for small businesses, as the money goes toward a specific purchase.

- Quick and Easy Access to Cash

- Collection Responsibility Falls on the Lender

- No loan installments