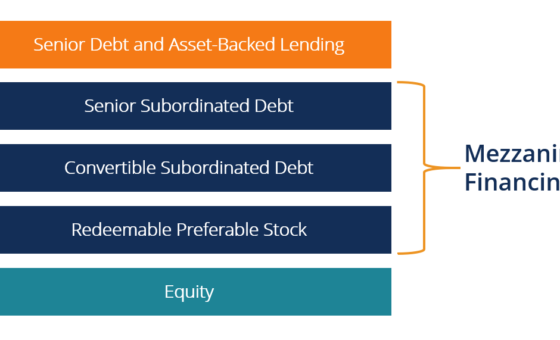

Mezzanine Financing

Mezzanine financing is a hybrid of debt and equity financing that gives the lender the right to convert the debt to an equity interest in the company in case of default, generally, after venture capital companies and other senior lenders are paid. In terms of risk, it exists between senior debt and equity.

Mezzanine debt has embedded equity instruments, often known as warrants, attached which increase the value of the subordinated debt and allow greater flexibility when dealing with bondholders. Mezzanine financing is frequently associated with acquisitions and buyouts, for which it may be used to prioritize new owners ahead of existing owners in case of bankruptcy.

- Mezzanine financing is a way for companies to raise funds for specific projects or to aid with an acquisition through a hybrid of debt and equity financing.

- Mezzanine lending is also used in mezzanine funds which are pooled investments, similar to mutual funds, that offer mezzanine financial to highly qualified businesses.

- This type of financing can provide more generous returns to investors compared to typical corporate debt, often paying between 12% and 20% a year.

- Mezzanine loans are most commonly utilized in the expansion of established companies rather than as start-up or early-phase financing.

- Both mezzanine financing and preferred equity are subject to being called in and replaced by lower interest financing if the market interest rate drops significantly.

A gap between senior debt and equity financing exists due to the following common reasons:

-

- Inventory, accounts receivable, and fixed assets are discounted at higher rates for fear of non-recognition of their value.

- There is a substantial volume of intangible assets recorded on the balance sheets.

- To address the rise in defaults and regulatory pressure, banks impose limits on the total debt that a business can acquire.

How Mezzanine Financing Works

Mezzanine financing bridges the gap between debt and equity financing and is one of the highest-risk forms of debt. It is senior to pure equity but subordinate to pure debt. However, this means that it also offers some of the highest returns to investors in debt when compared to other debt types, as it often receives rates between 12% and 20% per year, and sometimes as high as 30%. Mezzanine financing can be considered as very expensive debt or cheaper equity, because mezzanine financing carries a higher interest rate than the senior debt that companies would otherwise obtain through their banks but is substantially less expensive than equity in terms of the overall cost of capital. It is also less diluting of the company’s share value. In the end, mezzanine financing permits a business to more more capital and increase its returns on equity.

Companies will turn to mezzanine financing in order to fund specific growth projects or to help with acquisitions having short- to medium-term time horizons. Often, these loans will be funded by the company’s long-term investors and existing funders of the company’s capital. In that case of preferred equity, there is, in effect, no obligation to repay the money acquired through equity financing. Since there are no mandatory payments to be made, the company has more liquid capital available to it for investing in the business. Even a mezzanine loan requires only interest payments prior to maturity and thus also leaves more free capital in the hands of the business owner.

PROS & CONS

PROS

- Long-term “patient” debt

- Cheaper than raising equity

- Structural flexibility

- No dilutive effect on company’s equity

- Lenders tend to b long-term

CONS

- High interest rates

- Debt is subordinated

- Can be hard and slow to arrange

- May include restrictions on further credit

- Owner must relinquish some control