What Is Revenue-Based Financing

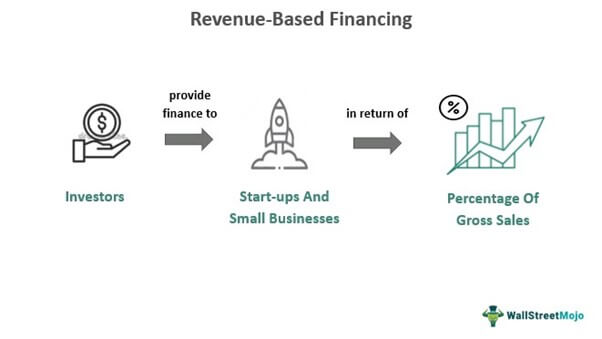

Revenue-based financing, also known as royalty-based financing, is a method of raising capital for a business from investors who receive a percentage of the enterprise’s ongoing gross revenues in exchange for the money they invested.

In a revenue-based financing investment, investors receive a regular share of the businesses income until a predetermined amount has been paid. Typically, this predetermined amount is a multiple of the principal investment and usually ranges between three to five times the original amount invested.

How Revenue-Based Financing Works

Although an enterprise that raises capital through revenue-based financing will be required to make regular payments to pay down an investor’s principal, it is distinct from debt financing for a number of reasons. Interest is not paid on an outstanding balance, and there are no fixed payments.

Payments to an investor have a directly proportional relationship to how well the firm is doing. This is because payments vary based on the level of the business’s income. If sales fall off in one month, an investor will see his or her royalty payment reduced. Likewise, if the sales in the following month increase, payments to the investor for that month will also increase.

Revenue-based financing also differs from equity financing as the investor does not have direct ownership in the business. This is why revenue-based financing is often considered as a hybrid between debt financing and equity financing.

In some ways, revenue-based financing is similar to accounts receivables-based financing, a type of asset-financing arrangement in which a company uses its receivables—outstanding invoices or money owed by customers—to receive financing. The company receives an amount that is equal to a reduced value of the receivables pledged. The receivables’ age largely impacts the amount of financing the company receives.

-

Revenue-based financing is a way that firms can raise capital by pledging a percentage of future ongoing revenues in exchange for money invested.

-

A portion of revenues will be paid to investors at a pre-established percentage until a certain multiple of the original investment has been repaid.

-

Revenue-based financing is usually considered distinct from both debt and equity-based funding.

-

Municipal bonds are a hybrid example of revenue-based debt financing.